The Bill Squeeze: Why “The Economy” Feels Like Two Different Worlds

AI Image via Robert Anthony Art

The Bill Squeeze: Why “The Economy” Feels Like Two Different Worlds

Your paycheck hits the account and it’s gone before you can blink.

Rent (or the mortgage). Groceries. Gas. Insurance. A doctor bill that shows up two weeks after you thought you already paid. And if you’re trying to get ahead—saving, investing, planning a future—it can feel like you’re running up a down escalator.

So when people argue about “the economy,” they’re not always arguing about numbers. They’re arguing about life.

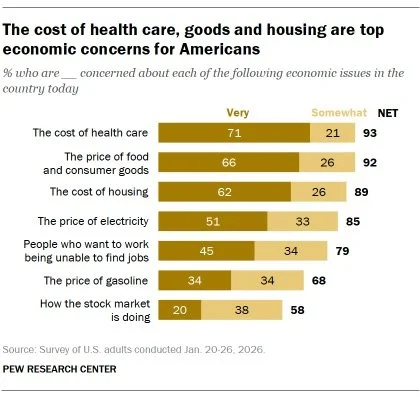

A national survey from Pew Research Center shows the biggest “very concerned” items are health care (71%), food/consumer goods (66%), and housing (62%)—the stuff you can’t avoid. And when the AP-NORC Center for Public Affairs Research asked what government should focus on in 2026, people said “the money stuff” first: about 7 in 10 mentioned at least one economic issue, and 43% mentioned personal finances.

That’s the real story: Americans aren’t asking for a perfect economy. They’re asking for an economy they can live in.

The three costs people feel in their bones

Health care is the cost you can’t plan. Groceries are the cost you see every week. Housing is the cost that decides where you can live—and what kind of future you can build.

Health care: one bad week can wreck the year

You don’t schedule a broken arm or a scary chest pain moment. You just get the bill. Even with insurance, people get hit with deductibles, copays, surprise out-of-network charges, or prescription prices that make you stare at the receipt like it’s a prank.

Groceries: the weekly punch in the face

You don’t need an economist to tell you food is expensive. You feel it when you buy the same basics and the total is $40 higher. You swap brands. You skip “extras.” You stretch leftovers. You still leave thinking: How did that cost so much?

Housing: the monthly cliff

Rent goes up and you don’t get to negotiate. Mortgage rates jump and buying slips farther away. Housing doesn’t just affect your budget—it affects your timeline: moving out, starting a family, saving, retiring.

Here’s what Americans say they’re most stressed about—and it’s the stuff you pay for every single month.

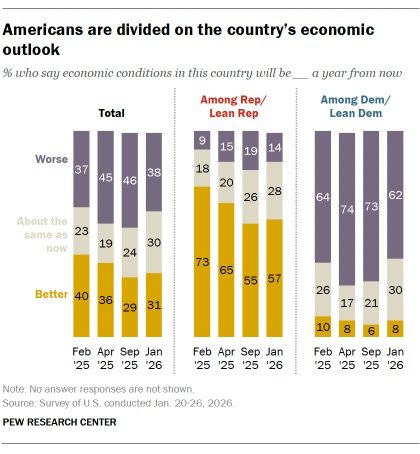

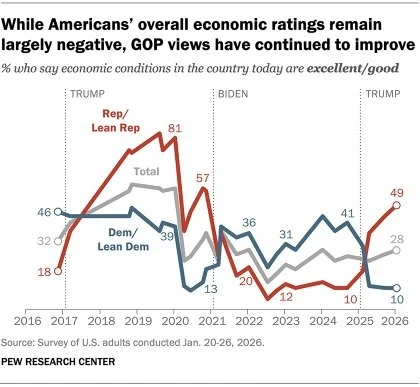

Why people argue about the economy like it’s two different planets

You’ll hear one person say, “things are fine,” and another say, “we’re drowning.” Both feel like they’re telling the truth.

Because not everyone lives in the same economy.

If you bought a home years ago and your payment is locked in, you’re not getting hit the same way as someone whose rent just jumped. If your job is steady, you breathe. If your hours got cut, every bill feels louder.

And then politics pours gasoline on it—because people filter the same reality through totally different teams and media worlds.

This is why two people can look at the same economy and feel like they’re living in different countries.

The future: wages, AI, and why “stable” might get harder

Even if prices cool down, the next question is: will paychecks keep up?

Lots of people get a raise and still feel behind because the basics eat it—rent, insurance, groceries, debt. So the fear becomes simple: What if my pay doesn’t rise as fast as my life costs?

Now add AI.

AI is coming for office work, too

For a long time, people thought automation meant factory jobs. But now the office is getting automated.

Think about a classic entry-level white-collar job: pulling numbers, cleaning spreadsheets, making charts, writing a quick report. That used to be a stepping-stone role.

Now more of that work can be done faster with AI—especially models built to use tools.

Anthropic’s Claude Opus 4.6 is part of that push. And their work on advanced tool use and tool-use agents is designed to make models do real tasks inside workflows, not just talk.

In plain terms: companies will try to see how much work a smaller team can get done when one person has AI helping with the “first draft” of everything.

That can mean fewer entry-level openings, slower hiring, and more pressure on wages in certain office tracks. Not because every job disappears overnight—but because the ladder’s first rung starts to look crowded.

Markets notice this, too. Reuters reported investors sold off some traditional software stocks after an Anthropic upgrade, worried about how fast AI could disrupt the industry. Reuters report.

Future impact: if AI helps companies do more with fewer people, the fight for “good jobs” gets tougher—especially for younger workers trying to start a stable adult life.

People aren’t even sure what next year looks like

Some people are hopeful. Some people are braced for worse. A lot of people just feel uncertain—and uncertainty changes behavior. People delay big steps: moving, kids, school, buying a home, investing.

And it’s not just today—Americans are split on whether next year will feel better or worse.

The market: up, down, and emotionally exhausting

Stocks can be up while your life feels down. That’s why “the market is doing great” often makes people roll their eyes.

Markets swing. Retirement accounts swing. Headlines swing. The lesson most people learn the hard way is that panic-selling locks in losses, and patience—while boring—often wins.

Gold and precious metals: why people keep looking at them

When people don’t trust prices or the future, they look for a “storm shelter.” For some, that means gold.

Gold can behave differently than stocks in certain periods, and some people use it for diversification. The World Gold Council’s overview explains the basic case.

But gold isn’t magic. It can drop, too. It’s just a different kind of risk.

Dividend investing: the boring idea that can help regular people

If you’re living tight, investing can sound like a rich-person hobby. But the point for normal people isn’t flexing. It’s building options.

Dividend investing is one approach people like because some companies pay cash dividends. Some investors reinvest those dividends to slowly build more shares over time.

The SEC’s plain-language page on dividend reinvestment plans (DRIPs) explains how that works, and FINRA’s overview also covers dividends and DRIPs.

The vibe isn’t “get rich quick.” It’s “build a second stream over time”—even if it starts tiny.

Closing: what people really want

This isn’t complicated. People want life to feel normal again.

A grocery trip that doesn’t hurt.

A rent renewal that doesn’t ruin the month.

A doctor visit that doesn’t start a debt spiral.

A job market where your future isn’t one software update away from stress.

That’s why those Pew numbers hit so hard. And that’s why AP-NORC shows people want leaders focused on the basics.

Disclaimer

This is for information and entertainment only. It is not financial, investing, legal, or medical advice. Decisions depend on your situation—consider talking to a qualified professional.

References

A Year Into Trump’s Second Term, Americans’ Views of the Economy Remain Negative

2026: The Public’s Priorities and Expectations

Tool use overview (agents and tools)

Anthropic releases AI upgrade as market punishes software stocks

Direct Investment Plans: Dividend Reinvestment Plans (DRIPs)